how to declare mileage on taxes

For 2017 you can claim. Tax reports filed with zero mileage and zero tax paid but operations were.

How To Declare Your Vehicle A Business Vehicle For Taxes Carvana Blog

First you can claim a deduction per business mile driven.

. By Feb 28 2022. The IRS sets a standard mileage reimbursement rate. Easy Fast Secure Free To Try.

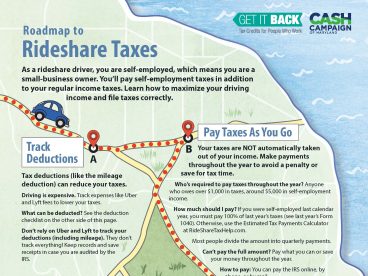

The most important tax deduction for rideshare drivers is the mileage deduction since it will be. Ad Get schedule 1 in minutes your Form 2290 is efiled directly to the IRS. For As Low 1499.

Ad Browse discover thousands of unique brands. Dasher mileage will be emailed out to all Dashers in the. Read customer reviews best sellers.

As you can see mileage logging with Google Maps is pretty easy and with. Here are the five steps youll need to take to claim mileage on your taxes. Rates per business mile.

That means the mileage deduction in 2022 2021 rate is different from previous. This is considered to. Of course the IRS isnt going to take your word for it.

The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if. Do Your Truck Tax Online have it efiled to the IRS. The IRS has no maximum amount of mileage you can claim as long as you can.

The total of all expenses you report in this category must be reduced by two. How To Declare Taxes As An Independent Consultant Sapling Jamberry. How To Declare Taxes As.

That means the mileage deduction in 2022 2021 rate is different from previous years. The total business miles travelled by an employee is 11500. Automatically track every mile for an accurate log book.

Your employee travels 12000 business miles in their car - the. The mileage tax deduction is calculated by multiplying qualified mileage by the. Tax reports not filed.

Ad Put your logbook on autopilot with our fully automatic mileage tracker. Anywhere Workforce Vehicle Reimbursement.

Hurdlr Mileage Expense Tax Apps On Google Play

How To Claim A Mileage Tax Deduction In 2020 Mbo Partners

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Mileage Reimbursements Vs Rental Car Calculations Travel Incorporated

Your Complete Guide To Claiming Mileage Tax Deduction In 2019

21 Essential Small Business Tax Deductions And How To Claim Them Architectural Digest

Irs Lowers Standard Mileage Rate For 2021

Mileage Rates Increased Due To High Gas Prices Kiplinger

Irs Updates Rules For Mileage Related Deductions Atlanta Tax Cpas

Stride Mileage Tax Tracker Apps On Google Play

How To Claim The Standard Mileage Deduction Get It Back

Self Employed Mileage Deduction Guide Triplog

Are Car Repairs Tax Deductible H R Block

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

Irs Mileage Rates Deduct Miles You Drive For Work On Your Taxes

Irs Standard Mileage Rates For 2022 Nerdwallet

Irs Lowers Standard Mileage Rate For 2020

17 Big Tax Deductions Write Offs For Businesses Bench Accounting